S&P Global has elevated Anastasia Beverly Hills’ debt rating from “D” to “CCC+”, confirming the change on Wednesday.

This adjustment follows a substantial $225 million cash input from founder Anastasia Soare into the company last December, part of a strategic debt restructuring plan which saw TPG Capital, its former major investor, significantly reduce its stake. TPG’s withdrawal erased most of its $600 million investment made in 2018, as reported by Bloomberg.

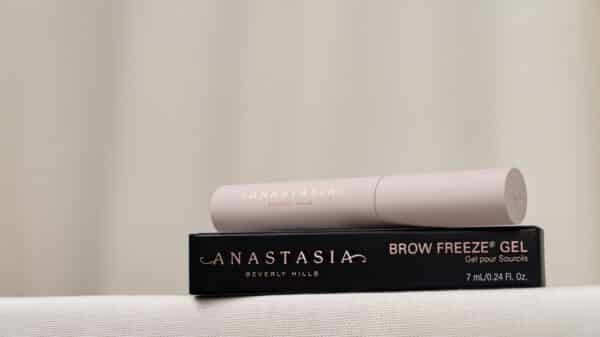

Renowned for its brow products and glamorous makeup lines, the premium cosmetics brand had been struggling under a burden of high debt and declining sales.

S&P indicates that the revamped capital structure now includes a new $272 million first-lien term loan set to mature in four and a half years. This loan integrates both rollover debt and accrued interest from its previous financial obligations, marking a significant reduction from over $600 million owed prior to the restructuring. Following this shift, Soare now retains a 55 percent ownership in the company, creditors hold approximately 39 percent, and TPG maintains a 6 percent equity.

S&P anticipates a better leverage situation for the company, projecting a reduction to about five times (compared to over 30 at one point). Nonetheless, it noted a 12 percent revenue decline for the year ending September 2025, along with potential risks from tariffs and competition from both lower-priced indie brands and larger corporate giants.