As we gear up for Prime Day this year, Amazon is taking a bold step into the world of luxury goods, aiming to navigate the choppy waters of tariffs that have affected many sellers, especially those sourcing from heavily taxed markets like China. With the backdrop of changing trade measures under President Trump, some sellers have made the difficult choice to step back from Prime Day, one of Amazon’s most anticipated sales events, to protect their profit margins.

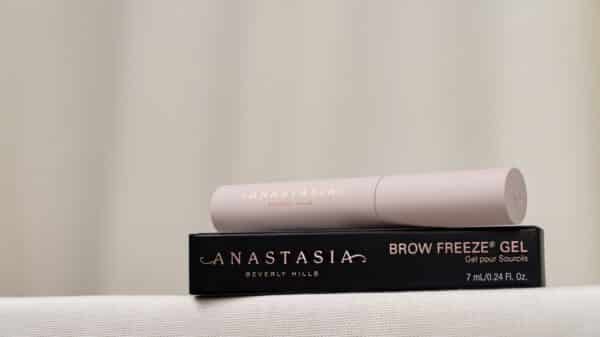

Prime Day, exclusively for Amazon Prime members, spans four days this year from July 8 to July 11. It’s a crucial moment for the company, and they’re not taking it lightly. Amazon is banking on the momentum gained in its Amazon Premium Beauty category, where sales of high-margin cosmetics have seen impressive growth. This strategy aims to counterbalance any potential dips in revenue or consumer sentiment due to external economic pressures.

“Beauty has become a necessity for many consumers,” shared Anna Mayo, vice president at NielsenIQ, underscoring how even in tight financial times, people prioritize beauty products. This shift has led luxury brands to rethink their earlier hesitations regarding selling on Amazon. Initially wary of diluting their brand image when Amazon launched its Premium Beauty section in 2013, brands like Estée Lauder, Olaplex, and L’Oréal’s Urban Decay now find themselves promoted prominently on the platform.

The stakes were high last Prime Day, with U.S. shoppers spending an eye-popping $14.2 billion, marking an 11% increase from the previous year, according to Adobe Analytics. Interestingly, while discounts on cosmetics may seem more modest—ranging between 10% and 17%—these products typically hold higher price points compared to other categories like electronics and apparel, where discounts can soar up to 22%. The strategic pricing structure for beauty products means they represent a profitable venture for Amazon, especially since smaller, higher-priced items can be shipped in volume, providing good margins.

Renee Parker, a former Amazon executive and co-founder of the consultancy firm Invinci, pointed out that while most categories on Amazon don’t yield substantial profits, premium beauty is an exception. The combination of high demand, compact sizes, and premium pricing makes it a goldmine for the retailer.

The rise of Amazon Premium Beauty can also be attributed to the company’s aggressive actions against counterfeits, which forced luxury brands to seek trustworthy avenues to reach consumers. Alfonso Emanuele de Leon, a seasoned player in the beauty industry, noted that Amazon’s reputation has evolved dramatically; it’s no longer seen as a digital hub for inexpensive, low-quality merchandise.

Reflecting on recent figures, Amazon Premium Beauty sales surged nearly 20%, hitting $15 billion from April 2024 to April 2025. This outpaced the overall growth of beauty products sold through other retail channels, which grew by 14% in the same period. Such impressive performance also signals a healthy online retail environment. Notably, L’Oréal’s CEO, Nicolas Hieronimus, mentioned that collaboration with Amazon has led to significant gains in U.S. market share.

Additionally, Estée Lauder has introduced 11 new brands on Amazon since March 2024, benefitting from a supply chain that primarily sources from the U.S. and Canada, effectively mitigating tariff impacts. Lauren Gordon, Estée Lauder’s vice president, emphasized that high-traffic events like Prime Day are critical for reaching both new and existing customers.

On Amazon’s end, Melis del Rey, general manager for health and beauty at Amazon U.S. stores, stated that the company is taking a proactive approach to manage tariff implications while engaging closely with premium brands.

The Amazon Premium Beauty program, an exclusive initiative for select brands sold through Amazon, has expanded to over 10,000 products. Brands like Dyson and Estée Lauder’s Aveda even participate in this scheme, paying an added commission to maintain a level of control over pricing and inventory. By bringing in esteemed names such as Unilever’s Dermalogica, Amazon is not only bolstering its beauty offerings but also positioning itself as a serious contender against established retailers like Ulta and Sephora.

As consumers prepare for Prime Day, it’s clear that Amazon is making strategic moves to cater to a wider audience—from luxury shoppers to the more budget-conscious, reflecting a deeper understanding of evolving consumer needs and preferences. Ultimately, amid the uncertainty of trade policies, Amazon’s entries into the luxury market are a calculated effort to maintain relevance and profitability in a competitive landscape.

Image Source: VIVINIE & TAMAS @ YOUTUBE